Memecoins vs Altcoins Explained: Utility, Narratives and Value

Most people think the difference between memecoins and altcoins is obvious.

Altcoins are “serious.” Memecoins are “jokes.”

That framing is outdated and misleading.

In today’s crypto market, both memecoins and altcoins derive value from the same core forces:

- belief,

- attention,

- narrative,

- liquidity.

The difference is not usefulness vs uselessness. It is how the story spreads and who believes in it.

Once you understand that, the entire debate changes.

What Are Altcoins? (The Traditional Definition)

Altcoins are defined as any cryptocurrency that is not Bitcoin.

Historically, altcoins were created to improve on Bitcoin in some way. Faster transactions, lower fees, smart contracts, privacy, scalability, governance, or interoperability. Each altcoin usually comes with a whitepaper, a roadmap, and a technical vision describing how it will change the world.

The traditional altcoin narrative looks like this:

- Technology first

- Utility creates demand

- Adoption follows functionality

- Price reflects usage

In theory, altcoins are products. Tokens are meant to represent access, coordination or participation in a network that provides real utility.

In practice, however, most altcoins do not derive value from usage.

They derive value from expectations.

Roadmaps are promises about the future. Utility is often delayed, changed or never fully delivered. Users speculate not on current cash flows or usage, but on what might happen if adoption arrives later.

This creates an uncomfortable reality.

Most altcoins today are valued not for what they do now, but for the story people tell about what they could become. That makes them far closer to narrative assets than traditional technology investments.

And once value comes from narrative rather than usage, the gap between altcoins and memecoins starts to shrink fast.

What Are Memecoins? (Beyond the Joke)

Memecoins are usually described as joke coins. Tokens with no utility, no roadmap, and no serious purpose.

That description misses the point.

Memecoins are narrative-first assets. They do not pretend that technology or future promises are the primary source of value. Instead, they are built around culture, identity, humor, timing, and collective belief.

The memecoin model looks like this:

- Narrative first

- Attention creates liquidity

- Liquidity creates price discovery

- Community sustains relevance

Memecoins do not sell a future product. They sell a shared idea in the present moment.

That idea can be simple, funny, absurd, or symbolic, but it spreads fast because it requires no technical understanding. Anyone can understand a meme. No whitepaper needed.

This is why memecoins travel faster through social networks than altcoins. They compress meaning into something instantly recognizable. A name, an image, a feeling.

In an attention-driven market, speed matters.

Memecoins also remove a key source of friction. There is no illusion of guaranteed utility. No complex roadmap to judge. No founders explaining why adoption will come later. Participants know exactly what they are buying into: belief, culture, and momentum.

Ironically, this honesty often makes memecoins easier to understand than altcoins.

When value is openly narrative-based, there is no mismatch between expectations and reality. The market prices belief directly, instead of pricing promises about future usefulness.

That is why memecoins are not irrational. They are simply financialized narratives.

And once you see them that way, it becomes clear why the performance gap between memecoins and altcoins is not accidental, but structural.

Memecoins vs Altcoins: Side-by-Side Comparison

This table strips away marketing language and compares memecoins and altcoins based on how they actually behave in real markets.

| Dimension | Altcoins | Memecoins |

|---|---|---|

| Core value driver | Promised utility and future use cases. Basically idea and narrative | Narrative, culture, shared belief |

| Primary narrative | Technological idea will create demand for the token | Attention and idea creates demand for the token |

| Complexity | High. Whitepapers, roadmaps, technical jargon, metrics, mechanics, team background, market size | Low. Simple idea, instantly understood |

| Speed of adoption | Slow. Requires education and onboarding | Fast. Spreads through memes |

| Community role | Needs real users, not bots. Also needs memes and active community | Sharing memes and spreading the idea power |

| Price discovery | Driven by expectations of future delivery, by metrics and revenue | Driven by attention and momentum |

| Bull market behavior | Often underperforms early. Need Bitcoin to pump first | Often explosive at any random moment |

| Bear market survival | Many goes to 0 once narrative breaks or new competitors arise | Strong memes often persist multiple cycles |

| Failure mode | Missed roadmap milestones or abandoned utility | Loss of idea and narrative relevance |

| Team risk | High. Teams can abandon the project, run out of funds, lose motivation or leave after earning enough | Low. Narrative-driven memecoins do not depend on a team. The idea can survive independently without ongoing manipulation |

| Hack risk | High. Even trusted and audited projects got hacked. While bad teams also practicing self hacks. | No risk. |

| Dependence on builders | Essential. Without the team, the idea weakens | Optional. Community sustains the idea, community can build on top without team |

| Transparency of value | Often unclear or blurred | Explicit and honest |

Key takeaway

There is no intention to present altcoins in a negative light compared to memecoins, but rather to show that real value comes from ideas, narrative, and community, not from some supposedly “super useful” utility.

The Uncomfortable Truth: Most Altcoins Are Memecoins in Disguise

This is the part of the debate most people avoid.

On the surface, altcoins look fundamentally different from memecoins. They have teams, roadmaps, technical documentation, and long explanations of what the protocol is supposed to do.

But when you strip away the language, the mechanism of value is often the same.

Altcoin tokens rarely represent ownership, cash flow, or guaranteed usage. In most cases, they represent belief in a future story. A promise that adoption will arrive later. A narrative that utility will eventually justify today’s valuation.

That is not fundamentally different from how memecoins work.

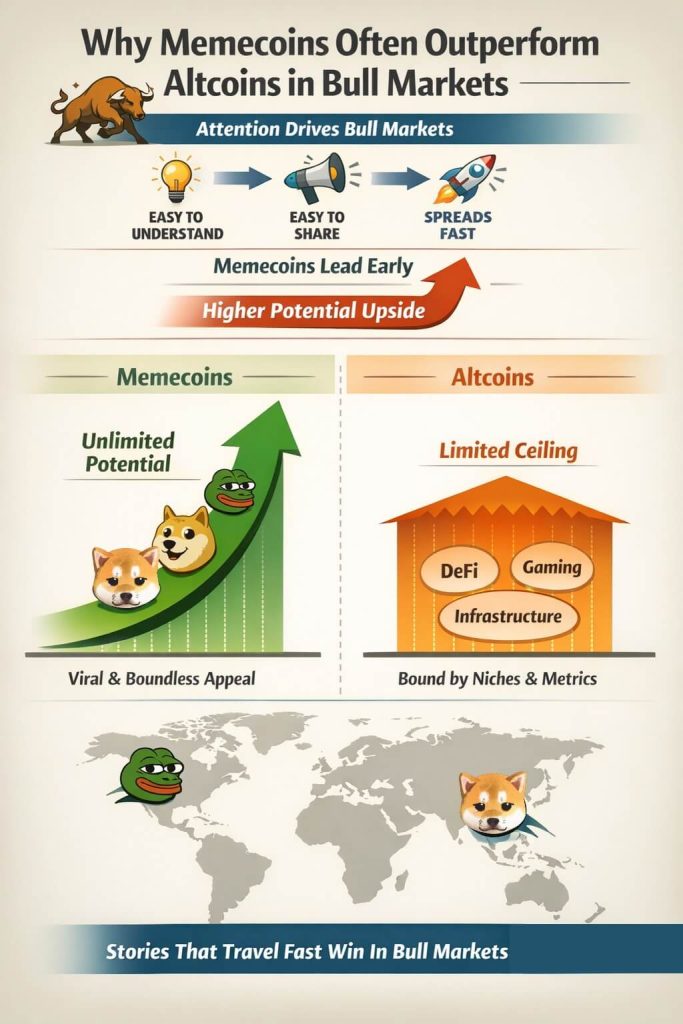

Why Memecoins Often Outperform Altcoins in Bull Markets

Bull markets are driven by attention before anything else.

When liquidity returns, money flows to what is easiest to understand, easiest to share, and fastest to spread. Memecoins fit this perfectly. A simple narrative can travel globally in days, sometimes hours.

This is why memecoins often lead the early and explosive phase of bull markets.

They also have higher ceilings.

If a narrative becomes truly worldwide, the upside is not capped by a niche or a specific metric. Doge, Pepe, and KIBSHI are examples of narratives that can spread across cultures, languages, and platforms without friction. A meme does not need onboarding, education, or product-market fit. It just needs belief.

Altcoins are different.

Their ceilings are usually limited by their category, competitors, or perceived market size. DeFi, gaming, infrastructure, or tooling all compete within narrow buckets. Metrics can change quickly, adoption can stall, and reported growth can be inorganic or temporary.

Memecoins are not bound by those constraints. Their upside is tied to how far the story can travel.

In bull markets, stories that travel fastest usually win first.

Are Memecoins Riskier Than Altcoins?

Memecoins are not necessarily riskier. They carry different risks.

Altcoins carry execution risk. Teams can abandon projects, run out of funding, pivot, or lose relevance. If the team fails, the idea often fails with it.

Memecoins carry attention risk. If people stop caring, the narrative fades because it’s short-term (weekly tiktok meme).

The key difference is transparency.

Altcoins often promise future value that may never arrive. Memecoins price belief openly, without pretending there is guaranteed utility coming later.

Both are speculative.

Real Examples: Narrative vs Reality

Memecoins (Story = Product)

| Coin | Narrative | Reality |

|---|---|---|

| DOGE | Internet joke turned global money | Cultural relevance, real usage, payments |

| KIBSHI | First AI-generated meme coin | Global AI trend relevance, real usage, payments |

| PEPE | Viral internet frog meme | Pure attention asset, no false promises |

| MOG | Humor and mogging culture | Lives or dies by attention only |

| FLOKI | Meme brand expansion | Narrative driven asset |

Altcoins (Story vs Delivery)

| Coin | Narrative | Reality |

|---|---|---|

| XRP | Global banking settlement token | Token utility remains limited after many years |

| UNI | Governance and future fee sharing | No revenue for holders since launch, fees still off |

| ADA | Ethereum killer blockchain (still not working) | Slow adoption, limited real demand, no chain usage |

| LINK | Oracles require LINK payments | Could settle oracle fees in ETH, token monetizes idea |

| AVAX | Copy of Ethereum tech with different parameters | Competes in a crowded L1 market (not much real demand or users) |

As you may see these altcoins have gigantic market caps and popularity while in reality barely need a token or a token itself is really used for something. So basically they are memecoins with serious faces.

XRP and ADA have massive communities that have shared belief in the future of their ideas and narratives, that’s what really drives the value. In reality these people not even using the tech, just holding the coins similar to others holding DOGE.

Final Thoughts: The Debate Is the Wrong Question

The real divide in crypto is not memecoins versus altcoins. It is clarity versus illusion. Memecoins are honest about what they are: belief, culture, and attention. Altcoins often promise future utility, but in reality many are priced on narratives that may never fully materialize. In an attention driven market, what people understand and share tends to outperform what needs years of explanation. The winners are not the most complex ideas, but the ones that remain relevant when belief, liquidity, and culture align.

People Also Ask

Are memecoins considered altcoins?

Yes. Technically all memecoins are altcoins, but not all altcoins behave differently from memecoins in practice.

Why do memecoins pump faster?

Because simple narratives spread faster than technical explanations. Attention moves quicker than adoption.

Do altcoins really have utility?

Some do, but many tokens are not required for the product to function. Utility is often overstated.

Why do memecoins have higher ceilings?

A global narrative has no market size limit. Niche protocols do.

Are altcoins safer than memecoins?

No. Altcoins carry execution and team risk. Memecoins carry attention risk.

Can an altcoin become a memecoin?

Yes. When price depends more on belief than usage, the distinction disappears.

*DISCLAIMER: The information in this article is for general informational purposes only and is not intended to be financial or investment advice. The content is not intended to be a substitute for professional financial or investment advice. Always seek the advice of a qualified financial or investment professional with any questions you may have regarding your financial or investment needs. The website owner and authors do not assume any liability for any decisions made based on the information provided on this website.

Follow Us: